— Samoa —

resilience. readiness. reform.

Building Resilience through Finance: Samoa’s Strategic Leap into Disaster Risk Preparedness

"The primary goal is to maximise the funding available to meet the needs of Samoa after a disaster without heavily impacting the Government’s annual budget." — Russell Leith, Samoa Disaster Risk Financing Strategic Plan, 2018

Challenge

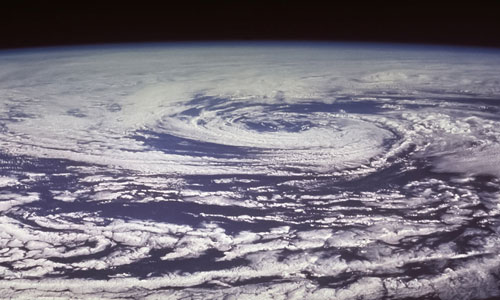

Samoa, a small island state vulnerable to cyclones, tsunamis, and earthquakes, faces natural disasters that inflict damages averaging 12% of GDP annually, significantly higher than most Pacific nations. Major events like Cyclone Evan (2012) and Cyclone Gita (2018) revealed systemic fiscal vulnerabilities and dependence on ad-hoc donor support and budget reallocations.

Despite some financial instruments in place—emergency funds, sovereign catastrophe insurance, and contingency budgets—the capacity to rapidly mobilize and execute post-disaster financing remained limited. Additionally, the private sector’s role in disaster preparedness was underdeveloped, and the insurance market lacked depth to meaningfully absorb large-scale risk.

Strategy

Under the World Bank–funded Pacific Resilience Program (PREP), Russell Leith led the development of Samoa’s first Disaster Risk Financing Strategic Plan, with Shaan Stevens contributing technical review. The strategy introduced a layered, risk-based financing approach, aligning public and private sector actions under a unified national framework.

The project focused on the following core objectives:

- Creation of a Rehabilitation and Recovery Fund (RRF) to cover medium- and high-risk events.

- Use of parametric insurance and contingency credit lines to allow fast, transparent payouts post-disaster.

- Development of a national risk exposure database and actuarial models to refine future financing strategies.

- Engagement with the private sector via public-private partnerships, fiscal incentives, and capacity building.

- Institutional strengthening across MOF, DMO, and line ministries, including procurement and emergency finance execution protocols.

The strategy was underpinned by international best practices, especially the Sendai Framework, and integrated into Samoa’s broader DRM legal and policy environment.

Transformation

Leith’s recommendations delivered a comprehensive, phased roadmap that helped Samoa move from reactive disaster funding to proactive risk-based financial planning. Key impacts included:

- Institutional alignment of MOF and DMO in post-disaster financial response.

- Adoption of a three-tiered risk financing model to match the scale and frequency of disasters.

- Identification of capitalization strategies for the RRF, including new tax instruments and donor co-financing mechanisms.

- Strengthened basis for private sector resilience, with the Chamber of Commerce signing an MOU with the government to promote business continuity planning and risk disclosure.

- A blueprint for future catastrophe bond issuance, parametric insurance expansion, and credit line access from international finance institutions

Samoa now stands as a regional leader in disaster risk financing, with the Leith-Stevens strategy offering a scalable model for other small island developing states.