Through strategic assessment and collaboration, GG International's intervention laid the foundation for a more inclusive and resilient microinsurance landscape in Malawi.

— Malawi —

inclusive. adaptive. resilient.

Strengthening Microinsurance in Malawi: 2014–2015 Support Program

"Microinsurance is not just about financial products—it’s about building resilience for those most vulnerable to risk."

— International Labour Organization, “Towards a Malawian Social Protection Floor”

Challenge

Between December 2014 and July 2015, Malawi faced significant challenges in providing effective risk protection for its low-income populations and farmers. The microinsurance sector was underdeveloped, characterized by:

- Limited access to affordable insurance products for rural communities.

- Regulatory gaps that hindered the growth and supervision of microinsurance providers

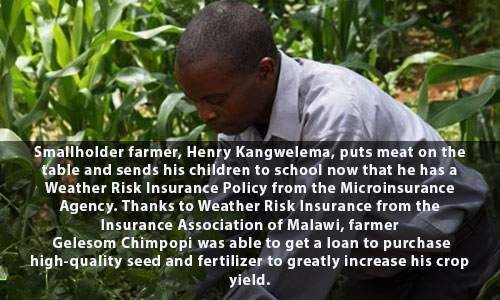

- Lack of tailored products addressing the specific needs of smallholder farmers, who are particularly vulnerable to climate-related risks.

These issues underscored the need for a comprehensive assessment and strategic intervention to enhance financial inclusion and resilience among Malawi's most vulnerable populations.

Strategy

In response to these challenges, GG International, under the leadership of Russell Leith, Director of the Insurance Finance and Risk thematic group, collaborated with the Reserve Bank of Malawi to implement a multifaceted project:

- Needs Assessment: Conducted a thorough review of the microinsurance environment, focusing on the requirements of low-income individuals and farmers. This baseline assessment provided critical insights into the demand for microinsurance products and the barriers to access.

- Regulatory Development: Utilizing the findings from the needs assessment, GG International assisted in formulating new insurance regulations specifically targeting the microinsurance sector. These regulations aimed to create an enabling environment for microinsurance providers, ensuring better oversight and consumer protection.

- Product Evaluation: Engaged with the three existing microinsurance organizations in Malawi to review and assess agricultural insurance products. The goal was to identify and promote products that were both suitable for the target populations and sustainable for providers.

Transformation

The project yielded significant outcomes that have contributed to the strengthening of Malawi's microinsurance sector:

- Enhanced Regulatory Framework: The development of targeted microinsurance regulations provided a structured and supportive environment for the growth of microinsurance services, aligning with international best practices

- Improved Product Offerings: The collaboration with existing microinsurance providers led to the refinement of agricultural insurance products, making them more responsive to the needs of smallholder farmers and increasing their uptake.

- Increased Financial Inclusion: By addressing both regulatory and product-related barriers, the project facilitated greater access to insurance for low-income populations, contributing to their financial resilience.