Smart, inclusive insurance is not a product — it’s a system, and SADC is now on the path to building one - Russell LEITH, GG International

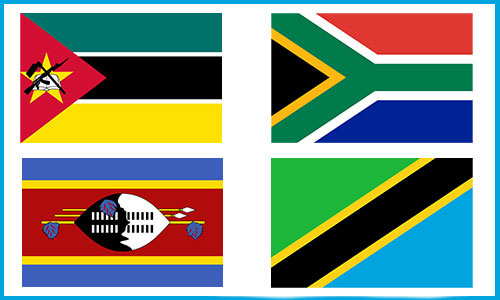

Mozambique | South Africa

Swaziland | Tanzania

resilient. inclusive. scalable.

Building Resilience Across Borders: Strengthening Agricultural Insurance in SADC Member States

"Agricultural insurance in Southern Africa must evolve from pilot schemes into systems-level solutions that build rural resilience, stabilize incomes, and attract private sector investment."

— FinMark Trust, Regional Agricultural Insurance Strategy Workshop Report, 2015

Challenge

From April 2014 to June 2015, GG International was engaged by FinMark Trust to support efforts aimed at improving the landscape of agricultural insurance across four SADC countries: South Africa, Swaziland (now Eswatini), Tanzania, and Mozambique. This initiative was a critical component of a broader regional push to enhance financial inclusion, support smallholder farmers, and climate-proof agriculture through improved risk management tools.

Each of the four countries faced a different mix of operational, regulatory, and technological limitations that affected the design, distribution, and adoption of agricultural insurance products. However, common challenges persisted:

- Limited digital infrastructure for insurance administration and claims management.

- Fragmented regulatory environments, with little harmonization across the region.

- Low uptake due to affordability concerns and lack of farmer awareness.

- Weak links between insurance providers, government subsidy programs, and private sector distributors.

FinMark Trust appointed Russell Leith, GG International’s Director of Insurance, Finance, and Risk, to lead a multi-country diagnostic and strategy process that would address these issues and inform a regional roadmap applicable to all 14 SADC countries.

Strategy

Over a 15-month period, Mr. Leith undertook a series of structured interventions designed to uncover system-wide barriers and promote practical, scalable reforms. Key components of the strategy included:

- Comprehensive IT System Reviews: Evaluated the capacity and scalability of core insurance management systems used by both public insurers and private providers in each country. Assessed data collection, premium processing, claim validation, and remote access.

- Policy and Regulatory Assessments: Compared legal and supervisory frameworks governing agricultural insurance, including the role of regulators, national agriculture ministries, and central banks. Identified gaps in index insurance regulations, reinsurance frameworks, and subsidy administration.

- Product and Market Analysis: Mapped the structure of available insurance products, such as weather-indexed crop insurance, livestock cover, and area yield guarantees, along with their pricing models and distribution strategies. Identified lack of actuarial data as a recurring constraint

- Stakeholder Engagement: Facilitated in-country consultations with insurance regulators, ministries of agriculture, national insurers, farmer cooperatives, and digital platform providers. These workshops led to collaborative insights on farmer engagement, bundled service delivery, and public-private partnerships.

- Synthesis of Regional Challenges and Solutions: Mr. Leith identified six challenges common to all four countries, ranging from policy fragmentation to low insurance literacy, and proposed a set of regional recommendations for all 14 SADC nations. These included:

- High fragmentation in microfinance delivery with inconsistent product quality.

- Minimal insurance literacy among rural populations.

- Limited outreach from conventional insurance providers in remote regions.

- Needs Assessment: Evidence-based surveys and interviews with farmers, local credit providers, and cooperatives to understand real-world risks and their economic impact. This revealed:

- Developing shared actuarial databases to support product pricing.

- Promoting mobile-based distribution channels to reduce cost barriers.

- Encouraging public-private innovation hubs for insurance product design.

- Standardizing regulatory guidelines for agricultural insurance across borders.

- Expanding government co-financing models for premium subsidies.

- Building region-wide awareness campaigns focused on smallholders.

Transformation

The project culminated in a SADC-wide strategic framework that was presented to regional policymakers, insurers, and development partners. FinMark Trust and SADC member states used the findings to initiate regional alignment efforts, including pilot programs for harmonized data platforms and subsidy models. Key outcomes included:

- Creation of a regional technical working group on agricultural insurance under SADC.

- Adoption of cross-country learning workshops to support implementation.

- Increased donor interest in digitally enabled, scalable insurance programs across the region.

- Strengthened policy dialogue between ministries of agriculture and finance on the importance of risk management in achieving food security.